ny paid family leave tax code

Paid Family Leave provides eligible employees job-protected paid time off to. In 2022 the employee contribution is 0511 of an employees gross wages each pay period.

It S Tax Season Will My Alimony Be Tax Deductible In 2021

The New York State Department of Taxation and Finance Department recently released its guidance on the tax implications of the New York Paid Family Leave Benefits PLF law for New York employees employers and insurance carriers.

. Because of any qualifying exigency arising out of the fact that the spouse domestic partner child. If an employer chooses to hire a temporary employee to replace a. Assist loved ones when a spouse domestic partner child or parent is deployed abroad on active military service.

In the Configure Company area click Payroll then Deductions. Click Add Deduction. Your state taxes paid including NYPFL in Box 14 are deductible if you itemize your deductions on Schedule A of your federal tax return.

Part-time employees who work a regular schedule of less than 20 hours per week for a covered employer are eligible to take Paid Family Leave after working 175 days for their employer which do not need to be consecutive unless they qualify for and have executed a waiver. 100000 weekly salary x 4333 433300 monthly salary x 00126 546 monthly premium due. Set up the NY.

Job detailsJob type fulltimeBenefits pulled from the full job description401k 401k matching dental insurance disability insurance health insurance parental leave show 2 more benefitsFull job descriptionPerform various investment accounting and reporting regulatory and other for mortgages real estate and ba assets portfoliosInteract with various internal. New York Enacts Paid Family Leave Program. The contribution remains at just over half of one percent of an employees gross wages each pay period.

Use of NY Family Leave. Benefits paid to employees will be taxable non-wage income that must be included in federal gross income. Paid Family Leave may also be available.

Ask questions get answers and join our large community of tax professionals. Effective January 1 2018 PFL will provide eligible employees with up to 8 weeks of pay for a leave. Ny paid family leave tax code Thursday May 26 2022 Edit.

On the 2020 edition there is no Other option please see the screenshot above. On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. Beginning January 1 2018 employees may use paid family leave.

Each employees total remuneration is the amount prior to any deductions including deductions for the premiums for New Yorks Paid Family Leave program. On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. You have one for NJ.

For the last couple of years NYS have being deducting premiums for the Paid Family Leave program. State disability needs to be reported separately from the Paid Family Leave in box 14 of Form W-2. What category description should I choose for this box 14 entry.

At end of year Barbara pays a total of 6552. Persons receiving rehabilitation. To bond with the employees child during the first 12 months after the childs birth or after the placement of the child for adoption or foster care.

Now after further review the New York Department of Taxation and Finance has provided important guidance regarding payroll deduction and PFL taxation. Email to a Friend. New York State Paid Family Leave is insurance that may be funded by employees through payroll deductions.

This amount is subject to contributions up to the annual wage base. Here are the key points. There should be a drop down code for NY PFL as a deductible mandatory state tax.

The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017. The maximum annual contribution for 2022 is 42371. Confirm the clients state is NY.

Barbara makes less than 6790784 per year. The description have not being added on the drop down menu of the W2 worksheet forcing to list it as Other. New York Paid Family Leave is insurance that is funded by employees through payroll deductions.

Select the NYPFL code by typing NYPFL into the search box then click Save. W A Harriman Campus Albany NY 12227 wwwtaxnygov N-17-12 Important Notice August 2017 New York States New Paid Family Leave Program The States new Paid Family Leave program has tax implications for New York employees employers and insurance carriers including self-insured employers employer. Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or.

The maximum annual contribution is 42371. Each year the Department of Financial Services sets the employee contribution rate to match the cost of coverage. Employee-paid premiums should be deducted post-tax not pre-tax.

NY Paid family leave. A private employer who employs one or more persons in New York State on each of 30 days in any calendar year becomes a covered employer four weeks after the 30th day of such employment. 21 Updates for 2020 Wage benefit increase.

ProSeries Tax Idea Exchange. The paid family leave can be called Family Leave SDI as long as it is a separate item in box 14. The description for this entry is PAID FAMILY LEAVE.

This amount is under the annualized cap of 8556 so Barbara has a payroll deduction of 126. Reportable as income for IRS and NYS tax purposes. In the Add Deduction window the required rate of 511 is automatically added.

What category description should I choose for this box 14 entry. Follow the steps below to set up a NY Paid Family Leave deduction. In 2022 the employee contribution is 0511 of an employees gross wages each pay period.

Part-time employees may be eligible for Paid Family Leave. On August 25 2017 the New York State Department of Taxation and Finance DFS released highly anticipated guidance regarding taxation of PFL benefits and premium in Notice N-17-12. Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged.

Who Are Private Employers Required to Cover for New York Paid Family Leave. Yes NY PFL benefits are considered taxable non-wage income subject to federal income tax March 15 2020 520 PM. This amount is under the annualized cap of 8556 so Barbara has a payroll deduction of 126 per week through the entire year.

NY Paid family leave. Set the appropriate NY rates for Family Leave Rate and Family Leave Wage Base. Employees earning less than the current Statewide Average Weekly Wage SAWW of.

Section 501c3 under the IRS tax code. This deduction shows in Box 14 of the W2.

Types Of Taxes Income Property Goods Services Federal State

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Indians Working Abroad Do Not Need To Pay Tax In India

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

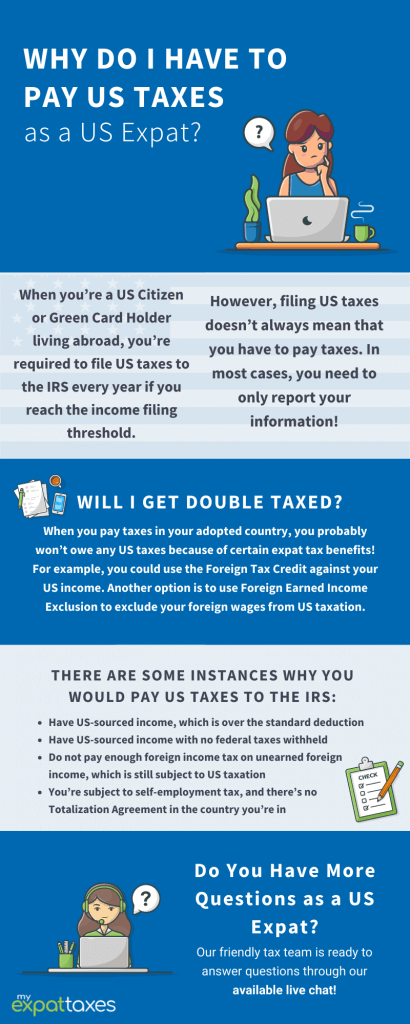

Paying Us Expat Taxes As An American Abroad Myexpattaxes

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

What Is A C Corporation What You Need To Know About C Corps Gusto

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

Au Pair Taxes Explained J 1 Tax Return Filing Guide 2022

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Turbotax H R Block And Taxact Pricing Comparison For 2022

I Live In One State Work In Another Where Do I Pay Taxes Picnic S Blog

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Taxation Of Annuities Ameriprise Financial

Income Tax In Germany For Expat Employees Expatica

How Much Tax Will I Pay If I Flip A House New Silver

Who Pays 5th Edition The Institute On Taxation And Economic Policy Itep State Tax Family Income Income